Article by Jacob Lachapelle, CIT at Maestro Digital Mine, for the Canadian Mining Journal, November Edition 2023

There is a transformation taking place in mining, and it is not being driven by regulatory guidelines and public sentiment, but by financial juggernauts that control the purse strings of this industry.

BlackRock is at the frontline of this movement, placing a strong emphasis on ESG (Environmental, Social, and Governance) principles. This shift towards ESG is reshaping the landscape of investment strategies in the mining sector, pushing companies to evolve and adapt to meet these new criteria.

Fink and BlackRock are part of a larger shift in the financial industry that views sustainability as a financial necessity. This shift is clearly visible in the actions of asset managers such as BlackRock and Vanguard who handle trillions of dollars in investment dollars. They are increasingly prioritizing ESG factors by providing guidelines for industries and businesses to adhere to ESG standards.

Confronted with this reality, mining companies find themselves at a crossroads. Given the capital-intensive nature of their operations and their reliance on external funding, mining companies must demonstrate an unwavering commitment to ESG goals to secure the necessary funding.

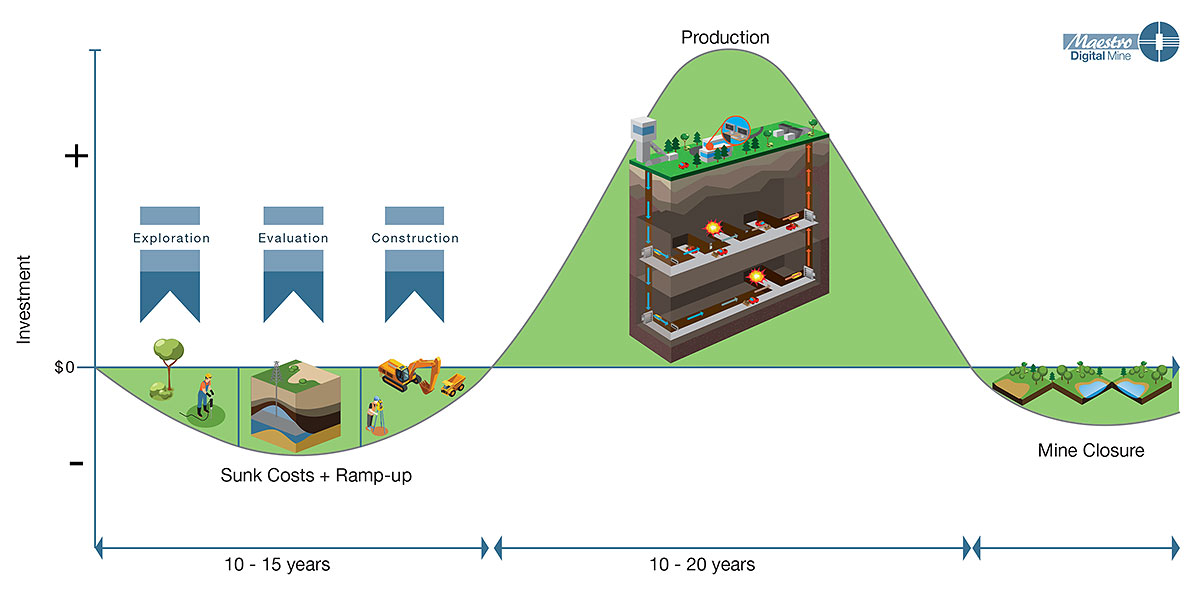

The inherently capital-intensive nature of the mining sector makes it particularly vulnerable to shifts in investment criteria. While other industries may have more flexibility to adapt to changing expectations, the significant upfront costs and long project timelines associated with mining mean that companies in this sector must be proactive in aligning their operations with ESG principles.

Examining the differences between the mining sector and traditional industries reveals the unique challenges mining companies face.

Read the PDF version of this article here.

Read the complete article at the CMJ Digital Edition site here (Page 20).